Real Time Credit Card Transactions Over The Internet

Virtual WebLink

The Virtual WebLink allows Internet-based businesses to authorize, process, and manage credit card transactions without worrying about all the complicated software, hardware, and expertise normally associated with processing payments over the Web. This is the web’s best real-time transaction system.

How It Works

Linking your Web site to the the Virtual WebLink system is simple. You simply insert a few lines of HTML code that we provide to establish the link. When online customers are ready to purchase products or services from your Web site, the Virtual WebLink displays a customized transaction page, hosted FREE on our servers, for the comsumer to enter in the necessary information (name, credit card number, etc.)

Free Shopping Cart

We offer a completely free Shopping Cart for you website. Add just a few lines of code on to any webpage and you have a shopping cart page, it is that simple. We have full technical support to help you through the entire process. Don’t buy a shopping cart when you can use ours for free.

This information is encrypted using 128 bit Secure Socket Layer technology and sent to the transaction server. The server then sends the data through the authorization network to the appropriate card issuer’s bank over a secure, proprietary connection. When the authorization process is complete — this takes around five seconds — the customer receives an approval or decline response, and the server stores the transaction.

Virtual WebTerminal

The Virtual WebTerminal allows you to enter payment information manually from phone, mail, faxed or retail orders. The Virtual WebTerminal enables businesses to authorize, process, and manage credit card transactions from any computer with an Internet connection and a Web browser. Virtual WebTerminal replaces standard Verifone or Hypercom authorization terminals or PC software and provides the best solution for merchants who manually enter credit card transactions for non real-time sales.

How It Works

It is easy to authorize credit card transactions, just complete an electronic form that provides the Virtual WebTerminal with the information it needs to complete the transaction. This information is encrypted using 128 bit Secure Socket Layer technology and sent to the transaction server. The server then sends the data through the authorization network to the appropriate card issuer’s bank over a secure, proprietary connection. When the process is complete — this takes around five seconds — the merchant receives an authorization number, and the server stores the transaction. Transactions are automatically settled each day. You can also check the status of transactions, automatically bill customers for recurring charges, or run a variety of reports.

- Protection from fraudulent transactions with FREE Address Verification Service (AVS) and CVV2.

- Complete online reporting capabilities.

- Accessing sales data from any computer in the world.

- Unlimited number of users simultaneously.

- Automatically settling transactions daily.

- No costly software upgrades and updates.

- Processing periodic/Automatic billing.

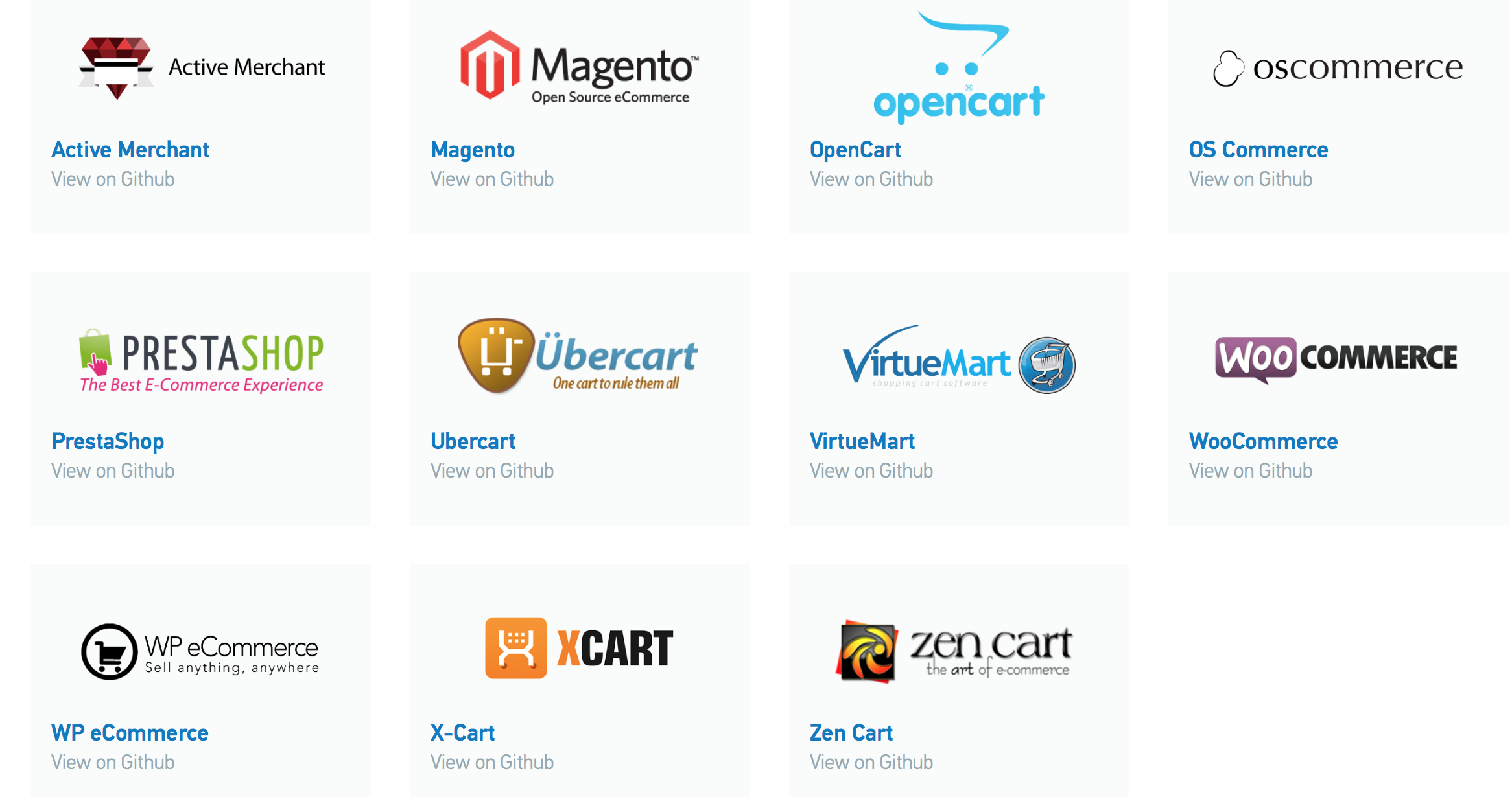

Widest Selection Of APIs For Developers And Compatibility

This section provides an overview of the components and concepts related to the development of client applications that communicate with Commerce Web Services (CWS) through the implementation of the SOAP/REST APIs. With the widest compatibility with 1000s of shopping carts and POS systems.

What is Commerce Web Services?

What is Commerce Web Services?

Commerce Web Services (CWS) provides payments integration access to software companies, financial institutions, and service providers seeking easy access to new payment services through the integration of a single API. For developers using .NET (C#/VB), Java, PHP, Ruby on Rails, and other object oriented development languages, documentation and support for payments integration is provided for both SOAP and REST implementation methodologies.

Integrating payment services within the applications using CWS provides an easy, low-cost, and efficient development experience. Utilizing a language neutral integration path, developers familiar with object-oriented languages are able to quickly enable access to multiple payment services and providers, while providing support for complex workflows. Seamlessly integrate host or terminal capture transaction processing workflows and value-added services supporting multiple payment types, including Bankcard Processing (BCP Credit/Debit), Stored Value Account (SVA), and Automated Clearing House (ACH).

CWS provides the following benefits to application developers:

- The comprehensive, yet simple API supports complex workflows and features such as line item data.

- Provides intelligent data management allowing you to store only the data needed by the application.

- Implements strong/mutual authentication of transaction originators.

- Supports multiple Bankcard payment types, such as Credit Cards and Debit Cards using the same API. Simply add the services your customers demand.

- Reduces maintenance costs by enabling a single integration to multiple service providers; thereby eliminating the need to maintain several one-to-one integrations.

- Open new sales channels by publishing your solution to a Commerce Marketplace giving reach to thousands of sales representatives—from payment processors, acquiring banks, and ISO’s—searching for the right solution for their customers.

What is SOAP?

The SOAP (Simple Object Access Protocol) protocol specification is used to exchange structured information in the implementation of Web Services in computer networks. It relies on XML (Extensible Markup Language) as its message format, and usually relies on other Application Layer protocols (most notably Remote Procedure Call (RPC) and HTTP) for message negotiation and transmission. SOAP can form the foundation layer of a web services protocol stack, providing a basic messaging framework upon which web services can be built.

A SOAP message could be sent to a web service-enabled web site with the parameters needed for a search. The site would then return an XML-formatted document with the resulting data. Because the data is returned in a standardized, machine-readable format, it could then be integrated directly into a third-party site.

What is REST?

The REST (Representational State Transfer) architecture was developed in parallel with the HTTP/1.1 protocol based on the existing HTTP/1.0 design. The REST-style architecture consists of clients that initiate requests, and servers that process these requests and return appropriate responses.

Requests and responses are built around the transfer of “representations” of resources. A resource is any source of specific information. In order to manipulate this information, clients communicate with a server via HTTP and exchange representations of these resources (the actual document conveying the information). A representation of a resource is typically a document that captures the current or intended state of a resource.

When browsing the World Wide Web, you enter a Uniform Resource Locator (URL) in your web browser in order to see a specific web page. The web page is considered a resource and is usually a document in HTML format. It could also represent a record in a database, or even the database itself, that is displayed on an HTML page. This concept was written into the HTTP specification. The REST principles build on top of the HTTP specification and its URL/resource relationships.

URLs are hierarchical in nature. URLs that identify a collection of child resources then adding a new segment will identify a resource within the collection. As a result, collections of collections can result in long URLs.

QuickBooks Integration

The QuickBooks Plug-in module allows merchants to consolidate their Internet, Mobile, and POS credit card and check transactions together with the software most commonly used to run a business.

How It Works

Process Credit Card And Check Transactions FROM DIRECTLY WITHIN QuickBooks® Pro, QuickBooks® Premier And QuickBooks® Enterprise Solutions. Apply payment to open invoices. Integrate Internet, POS, Mobile and Recurring Transactions processed through the Virtual WebTerminal directly Into QuickBooks®. Supports Tthe MagTek USB MagStripe reader For SWIPED RATES. Merchants can use one Merchant Account for all sales channels.